Key Takeaways

- Learn the primary types of payroll systems and how they suit various business structures.

- Discover features essential for streamlined payroll and compliance.

- Understand why system integration is vital for business efficiency.

- Recognize the necessity of scalable software that can support future growth.

- Explore compliance tools that safeguard against regulatory pitfalls.

Payroll management becomes increasingly challenging as businesses scale. To ensure ongoing accuracy, compliance, and employee satisfaction, selecting the ideal payroll system is essential for any growth-oriented organization. Whether you run a startup with just a handful of employees or a thriving company with expanding teams, finding a user-friendly payroll for very small teams can set a solid foundation for future growth and smooth operations.

Payroll mistakes can lead to costly compliance issues and unhappy employees, making a robust payroll system a cornerstone of effective business administration. As your company evolves, understanding what features and integrations you’ll need from a payroll provider will help you avoid disruptive transitions or missed opportunities. With options ranging from in-house software solutions to fully outsourced services, each business must identify what aligns best with its current needs and vision for expansion.

This comprehensive guide explores crucial considerations for evaluating payroll systems, from essential features to integration capabilities, and offers recommendations designed to empower businesses at every growth stage. By the end, you’ll be equipped to make a well-informed decision that keeps your organization efficient, reliable, and compliant.

When beginning your search, it’s important to prioritize systems that address your immediate administrative challenges while providing the flexibility to accommodate future needs. Growth often brings additional complexities, so the right solution should be able to scale smoothly alongside your organization.

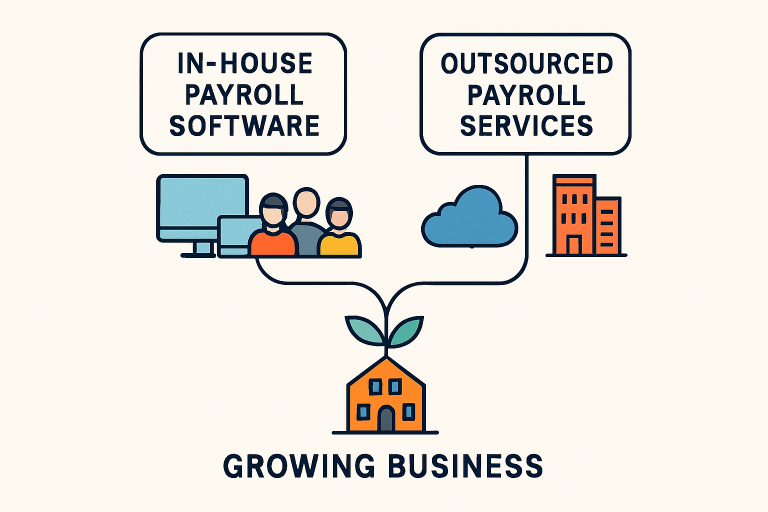

Understanding Payroll System Types

Every business has unique payroll needs, and payroll systems generally fall into two categories—each with distinct advantages and limitations:

- In-House Payroll Software: Managed internally, this option gives businesses full control over payroll operations. It requires a dedicated HR or finance team, along with ongoing training and support. In-house systems may be ideal for companies with complex pay structures or those needing full customization.

- Outsourced Payroll Services: Entrusted to a third-party provider, these services reduce the administrative burden on internal teams and typically handle tax filing, compliance, and employee payroll tasks. While outsourcing can streamline processes for smaller or rapidly growing companies, it may offer less flexibility for specialized needs.

The decision between in-house and outsourced payroll will hinge on your company’s resources, payroll complexity, and growth strategy.

Essential Features to Consider

Beyond simply issuing paychecks, your payroll system should deliver a suite of features that foster efficiency, accuracy, and adherence to regulations. Focus on solutions that provide:

- Automated Payroll Processing: Minimizes manual errors by calculating wages, bonuses, overtime, and deductions consistently and on time.

- Tax Filing Services: Handles tax calculations, filing, and compliance with local and federal laws, which is especially important as tax codes change.

- Employee Self-Service Portals: Empowers your team to access pay stubs, tax forms, and update personal information, saving HR time and minimizing data entry errors.

- Benefits Administration: Integrates benefits management, allowing staff to view, enroll, or make changes to health, dental, or retirement plans through a single platform.

Features like automated reminders, report generation, and multi-state payroll support can also provide big value as your business expands. For additional guidance on payroll challenges and regulatory compliance, resources like the U.S. Department of Labor offer insightful articles for business leaders.

Integration with Existing Systems

Modern payroll solutions should not operate in isolation. Instead, they need to integrate smoothly with your existing accounting, HR, and time-tracking systems. Seamless integration with platforms like QuickBooks, Xero, or your HR management suite ensures data consistency and minimizes double-entry or reconciliation errors. Successful integration boosts productivity, reduces administrative overhead, and delivers actionable financial insights.

Scalability for Future Growth

As employee headcount grows and workforce needs evolve, your payroll system must be agile enough to handle increased demands. Choose software that can process payroll for new hires, contractors, and complex payment structures—without requiring major, disruptive upgrades. Look for tiered pricing models or modular features that allow for smooth scaling as your business expands into new markets or regions.

Compliance and Regulatory Considerations

Ensuring payroll compliance is crucial, as federal, state, and local laws evolve regularly. Your chosen payroll system should update automatically to reflect new tax codes and labor regulations, helping you avoid penalties from missed or inaccurate filings. Built-in audit trails, error-checking mechanisms, and regulatory reporting functions also minimize compliance risks, safeguarding your company’s reputation and finances. Up-to-date information about employment laws is available from the U.S. Department of Labor.

Cost Considerations

Comparing costs goes beyond evaluating monthly fees. Assess the total cost of ownership, factoring in setup charges, ongoing subscription rates, add-on services, and any hidden fees. Balance these expenses against the time and administrative savings—and potential risk reduction—the right payroll solution can deliver. Price transparency is key; reputable providers will clearly outline what’s included in each plan or offering.

Top Payroll Software Solutions for Growing Businesses

- Gusto: A full-service platform popular for its intuitive interface and broad feature set, Gusto handles everything from payroll and tax filings to benefits administration and compliance. With customizable plans, it is well-suited to organizations that expect to grow or change quickly.

- QuickBooks Payroll: Seamlessly integrates with QuickBooks accounting software, offering efficient payroll runs, direct deposits, and even same-day payroll for eligible users. Robust tax automation and time-tracking integrations make it a top choice for businesses already using QuickBooks.

- Paychex Flex: Known for its flexibility and industry-specific options, Paychex Flex supports businesses at every stage of their growth. With advanced analytics, HR tools, and multiple integration options, it’s a powerful tool for scaling operations.

Implementation Strategies for Seamless Integration

- Thorough Training: Properly prepare payroll and HR staff to use new systems by providing comprehensive training and ongoing support.

- Data Migration Planning: Carefully plan for the migration of employee and pay data, verifying accuracy before phasing out any legacy systems.

- Customization and Configuration: Tailor the software to your organization’s policies on pay, benefits, and deductions for a custom fit.

- Integration with Existing Systems: Ensure the payroll platform works seamlessly with your HR, accounting, and time-tracking tools for maximum efficiency.

- Change Management: Communicate benefits, provide resources, and solicit feedback to ensure smooth adoption by everyone involved.

- Regular Audits and Quality Checks: Monitor system accuracy and routinely check payroll processes for errors or compliance gaps.

- Ongoing Support and Maintenance: Maintain vendor support relationships for fast resolution of technical issues and access to new features as they roll out.

Conclusion

The right payroll solution fuels growth by automating administrative tasks, fostering compliance, and enhancing the employee experience. Evaluating essential features, integration capabilities, scalability, and cost helps ensure you select a system that aligns perfectly with your goals—today and well into the future.